If you loathe Ticketmaster for its infamous service fees or the software overload that cost you Taylor Swift tickets this summer, just know that Fred Rosen is unmoved by your anger.

“The public brought all this on itself,” said Rosen, the 79-year-old former chief executive of Ticketmaster, who grew it into an inescapable presence for concert and sports fans in the 1980s and ’90s.

“I have no sympathy for people whining about high ticket prices,” he continued, pointing a finger at fans who downloaded music without paying for it during the heyday of file-sharing services like Napster. “They helped create this situation where artists have to make all their money on tour. Artists and the market set the prices, and you can’t pay a Motel 6 price and stay at the Four Seasons.”

Subscribers get exclusive access to this story

We’re offering L.A. Times subscribers special access to our best journalism. Thank you for your support.

Explore more Subscriber Exclusive content.

Fans, artists and government regulators have lambasted Ticketmaster for 30 years. But after tech failures shut out millions of fans from the on-sale for Swift’s Eras tour in November, the ticketing firm came under fire from all sides.

Furious Swifties filed a class action lawsuit against Ticketmaster, joining at least 15 other suits in the last five years against the company and its parent firm, concert promotion giant Live Nation Entertainment, that claimed anticompetitive practices. Swift herself said, “I’m not going to make excuses for anyone because we asked [Ticketmaster], multiple times, if they could handle this kind of demand and we were assured they could. … It really pisses me off that a lot of [fans] feel like they went through several bear attacks to get them.”

Bad Bunny fans found common cause after thousands attending the rapper’s December Mexico City stadium show were turned away for allegedly fake tickets. (Mexican President Andrés Manuel López Obrador said he will penalize Ticketmaster.) Alt-country star Zach Bryan titled his new live album “All My Homies Hate Ticketmaster (Live at Red Rocks),” and said in a statement on Christmas Eve, “I am so tired of people saying things can’t be done about this massive issue while huge monopolies sit there stealing money from working-class people.”

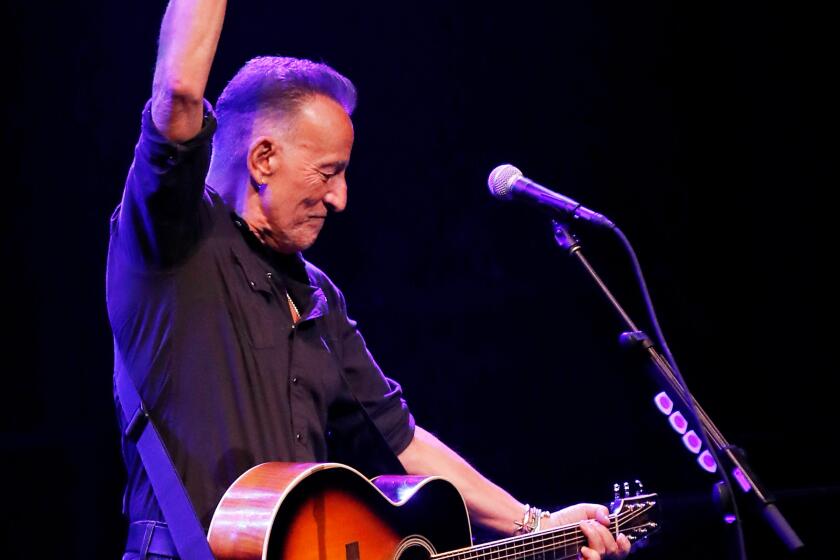

Even a beloved act like Bruce Springsteen had to answer for eyebrow-raising ticket prices on his upcoming tour; they hit $5,000 after he used Ticketmaster’s “dynamic pricing” model, which responds to rapid demand by raising prices in real time.

“Ticket buying has gotten very confusing, not just for the fans but for the artists,” Springsteen admitted.

A ticketing practice known as ‘dynamic pricing’ caused some serious sticker shock for fans hoping to see the Boss on his 2023 tour.

Members of the U.S. Congress, from Sen. Amy Klobuchar (D-Minn.) to Rep. Alexandria Ocasio-Cortez (D-N.Y.), lambasted Live Nation Entertainment, promising legislation to check the company’s power and urging the Department of Justice to reexamine the consent decree that allowed Ticketmaster to merge with Live Nation back in 2010. In 2019, the DOJ said that new regulations on Ticketmaster were “the most significant enforcement action of an existing antitrust decree by the Department in 20 years.”

“Live Nation and Ticketmaster are the owners of venues, they’re vertically integrated and they sell the tickets,” Klobuchar told The Times in November. “Artists are afraid to go through anyone but them, and they favor their own venues. ... If you own it all, you can thumb your nose at the marketplace, and that puts this problem in the hands of the Justice Department.”

Klobuchar and Mike Lee (R-Utah) will lead a Senate Judiciary Committee hearing about competition issues in the U.S. ticketing market on Jan. 24.

Even President Biden weighed in. Asked about the Swift debacle, White House Press Secretary Karine Jean-Pierre said that the president believes that “capitalism without competition isn’t capitalism, it’s exploitation.”

In a statement after the botched on-sale, Ticketmaster wrote, “We strive to make ticket buying as easy as possible for fans, but that hasn’t been the case for many people trying to buy tickets for the Eras Tour. ... The biggest venues and artists turn to us because we have the leading ticketing technology in the world — that doesn’t mean it’s perfect, and clearly for Taylor’s on-sale it wasn’t.”

Live Nation Entertainment President and Chief Financial Officer Joe Berchtold, in advance written testimony provided to The Times before Live Nation’s Senate Judiciary Committee hearing Tuesday, said that “Ticketmaster comes under a lot of criticism ... But I can say with great confidence that ... its performance in large onsales is the best in the industry, it has the best marketing capabilities of any ticketing system, and it is far and away the leader in preventing fraud and getting tickets into the hands of real fans.”

Yet the actual role that Ticketmaster plays in live music is widely misunderstood. Over a dozen interviews with former Ticketmaster executives, artist managers, economists, lawmakers, antitrust experts, fans and industry insiders, many agreed that Ticketmaster is enormous and largely unaccountable to fans. But, they said, it is also a mostly effective business with few peers capable of operating at its scale.

“Ticketmaster got thrown under the bus because it’s easy to throw them under the bus,” Rosen said. “There is no solution that won’t piss people off more.”

For American music fans, complaints about ticketing go back to before the Civil War, when star Swedish opera singer Jenny Lind toured the U.S. under the auspices of promoter P.T. Barnum, prompting riots and howls of corruption when her shows instantly sold out at inflated prices.

Steve Waksman, the author of “Live Music in America,” said that even into the 1960s and ’70s, there was some expectation that music — especially the rock ’n’ roll of the hippie counterculture —-should be “free for the community, and to some degree anticapitalist.”

“The idea that fans are owed something is not new,” Waksman said. “But now it’s not a counterculture idea, it’s more consumer entitlement. Artists have built up these enormous fan relationships strengthened by social media, where fans think they’re owed something because of their devotion.”

Ticketmaster, with its 6,500 worldwide employees (compared to 44,000 at Live Nation Entertainment), controls close to 80% of the ticket market in the U.S. With estimated annual profits of $750 million, it is the most lucrative piece of the Live Nation conglomerate, which cleared $15 billion in yearly revenue as of Sept. 30. The company is overseen by Live Nation Entertainment Chief Executive Michael Rapino.

While there are competitors such as AEG’s ticketing arm AXS, SeatGeek, Eventbrite and Tessera, no one comes close to Ticketmaster’s market power.

Ticketmaster’s business covers much more than concerts. If you want to see the Lakers at Crypto.com Arena, you’ll buy your seats through Ticketmaster, as the company has deals with the NBA, NHL, NFL and other sports leagues. Live Nation owns or operates some venues exclusively (like the Hollywood Palladium and YouTube Theater) and leases nights at others like the Hollywood Bowl and SoFi Stadium, where they pay the venue fees to produce shows.

Founded in the 1970s in Arizona by box office executive Albert Leffler and computer programmer Peter Gadwa, among others, the company licensed nascent ticketing software and machinery to promoters and venues. Rosen, the company’s attorney, took it over in 1982, moving it to Los Angeles with investments from the billionaire Pritzker family, and bought the rights to Bay Area Seating Services, a leading competitor. “You don’t get very many chances to find somebody asleep at the switch,” Rosen told The Times in 1985. “It’s just a business that has been ignored. ... It’s the game. I want to win.”

Ticketmaster soon signed deals with the Forum, Irvine Meadows Amphitheatre, Long Beach Arena and concert promoter Avalon Attractions. Ticketmaster acquired its chief rival, Ticketron, in 1991.

“Every building manager knows selling tickets is thankless,” Rosen said. “But Ticketmaster had better tech than anybody in the industry. If a show cancels, you get your money back. If you’re an arena, you need your accounting and data center to work 365 days a year. No other system on earth could deal with that volume. And we ran a clean business — we wouldn’t deal with scalpers and canceled orders to brokers.”

After Microsoft co-founder Paul Allen bought a majority stake in 1993, the grunge group Pearl Jam declared war on Ticketmaster. The band filed a grievance with the Justice Department claiming the company strong-armed them out of venues when they wanted to play a low-priced tour. Through its exclusive deals with venues, Ticketmaster could “cement control over the distribution of tickets,” the band alleged, and testified before Congress about their experience.

“Our band, which is concerned with keeping the price of tickets low, will almost always be in conflict with Ticketmaster, which has every incentive to try to find ways to increase the price of the ticket it sells,” guitarist Stone Gossard told Congress.

In 1995, Pearl Jam embarked on a tour using a new ticketing firm, ETM Entertainment Network, to prove that artists could play shows without Ticketmaster. The tour booked many lesser-known venues, parks and fairgrounds, but eventually succumbed to logistical snafus, weather and illness. (It did, however, lead promoters to the Empire Polo Grounds in Indio, later the site of Coachella.)

“Pearl Jam walked into something they didn’t understand,” Rosen said. “I told their manager Kelly Curtis, ‘Your tour is going to be a mess, you’re going to be embarrassed. They said, ‘No, we’re going to change the industry,’ I said fine, you spit in my hand like that, you’re responsible when your tour blows up.”

In 1998, Barry Diller’s company, now IAC, bought a majority stake in Ticketmaster and acquired competitors like TicketWeb, software firm Paciolan Inc. and resellers Getmein and TicketsNow. The firm merged with Irving Azoff’s Front Line Management in 2008, and Live Nation acquired it in 2010 under a federal consent decree requiring it to license its software to AXS, and to not retaliate against venues using other platforms. Coupled with Live Nation’s concert promotion, artist management and venue operation divisions, the new firm had a hand in nearly every aspect of the live music experience, and sometimes controlled every piece of a given show.

Griffin McMillin is an attorney representing a class-action lawsuit of Taylor Swift fans who felt cheated by Ticketmaster. In November, more than 3.5 million Swift fans preregistered under the Verified Fan program to buy tickets, only to watch in horror as the website collapsed under 3.5 billion simultaneous attempts to buy tickets.

“I feel like they’ve done all this monopolistic behavior for so long, and this was just the straw that broke the camel’s back,” McMillin said. “They’re going to keep gathering more and more power, charging more and more, until concerts become this luxury for only the richest people and scalpers.”

Clay Murray, 25, one of the Swift fans involved in the suit, said that fans like him waited hours in the digital line for tickets, only to end up “sobbing, crying, really upset. People can’t afford to spend so much money, and I had done everything that I was supposed to do. It was personally devastating, and then the anger continued to grow.”

Music fans are not Ticketmaster’s main customers. The company signs contracts with promoters and venues to sell tickets to their events, and pays advances and fees for the right to do so. Many of the contracts are exclusive, but not all. The firm does not set the price of concert tickets — artists and promoters do. And while individual contracts vary, Ticketmaster splits its service fees with the artists, venues and promoters.

Case in point: For Blink-182’s reunion tour date at Banc of California Stadium on June 16, the list price of a “Platinum” ticket is $290. Add on a “service fee” of $42.90 and a “processing fee” of $5, and the price of admission (excluding parking and concessions) comes to $337.90. (There is no charge to have the ticket sent to your phone, but other shows can have “delivery charges” or “facility fees.”)

The “service fee” is intentionally kept separate from the list price for two reasons: to make the base price of a ticket appear more affordable, and to create the impression that only Ticketmaster pockets that fee.

“The ticketing company does nothing whatsoever that the act doesn’t tell them to do,” said Bob Lefsetz, a longtime music industry analyst. “Fees were created to create another pile of money. Ticketmaster has been paid to take the heat over that for forever, so the public will never hate the act.”

Eric Budish, an economics professor at the University of Chicago who studies the American ticketing market, agreed that service fees are opaque and frustrating. But they’re largely designed to insulate artists, venues and promoters from criticism.

“Ticketmaster is effectively paid to be a punching bag,” Budish said. “Their fees find ways back to the artist or venue. And the artist chooses their ticket prices.”

“Primary ticketing companies, including Ticketmaster, do not set ticket prices, do not decide how many tickets go on sale and when they go on sale, do not set service fees,” Berchtold said in his Senate testimony. “Pricing and distribution strategies are determined by artists and teams ... In most cases venues set service and ticketing fees, and the majority of those fees go to the venue, not to Ticketmaster. Indeed, for as long as Live Nation has owned Ticketmaster, the portion of the service fee that Ticketmaster retains has been falling and the venue’s share has been increasing.”

Ticketmaster grew so vast, in part, because it was a good deal for everyone else in the industry, according to Dean Budnick, co-author of the book “Ticket Masters: The Rise of the Concert Industry and How the Public Got Scalped.”

“Ticketmaster and Live Nation are both unfairly criticized,” Budnick said. “Fred Rosen thought he was a good partner for taking the heat, and he’s not wrong. He took it on the chin for venues and promoters.”

Jonathan Daniel, an artist manager for Fall Out Boy and Green Day, used Ticketmaster and Live Nation to handle the bands’ Hella Mega stadium tour last year. “If Ticketmaster gets regulated, you’ll invite some new problems, because Ticketmaster solved a lot of them,” Daniel said. “You’ll still have websites crashing whether it’s Ticketmaster or Joe’s Tickets or whatever.”

Verified Fan, Ticketmaster’s system to suss out actual humans from bot traffic and scalpers, had worked for acts like Springsteen and Swift in the past. But even that system couldn’t accommodate the demand for Swift’s Eras.

“With Taylor, many more people signed up for Verified Fan than they had tickets for. It’s a first-of-its-kind problem,” Daniel said. “God bless Taylor, she’s extremely popular.”

Several high-ranking concert industry executives, who requested anonymity so they could speak freely about the competition, said they suspected Ticketmaster erred in placing all the Eras tickets on sale at once and allowing fans to pick their own seats, which led to bottlenecked traffic. They also believed the Verified Fan database was rife with resellers with fake email addresses.

After getting shut out, frustrated Swifties then watched coveted seats hit the secondary market at astronomical markups. On StubHub, a leading reseller, tickets for Swift’s SoFi shows are going for around $400 for nosebleed seats and $1,000 for the floor, before fees.

“There’s a perception that fans don’t stand a chance,” said Budish.

Subscriber Exclusive Alert

If you're an L.A. Times subscriber, you can sign up to get alerts about early or entirely exclusive content.

You may occasionally receive promotional content from the Los Angeles Times.

One 2016 study from the New York Attorney General found that more than half of the seats at an average show never went on sale to the general public but were instead reserved for presales, artist teams, fan clubs or as perks for certain credit card users.

Artists loathe secondary vendors too — the acts don’t get a cut of tickets reselling for multiples of face value. “No artist wants fans to overpay for something,” Daniel said. “But if it’s a hot ticket, the secondary market becomes unreasonable.”

Yet as much as fans hate resellers when they’re trying to buy, they love them when trying to flip their tickets.

“We have the tech to turn off the resale market — just put names on tickets like we do with airlines,” Budish said. “You show ID at the door and you can only buy two tickets, so money doesn’t go to brokers and there’s no feeling of a massive injustice. But the only reason it’s hard is because no one wants to actually solve that problem.”

Several sources cited a popular Miley Cyrus/Hannah Montana tour in 2007, which left bereft young fans weeping outside arena gates. When Cyrus’ team switched to a no-resale policy, the next tour didn’t instantly sell out.

“If Congress decided it was worth putting caps on the secondary market, you wouldn’t have the same pressure,” Budnick said. “But when you can’t resell tickets, people have issues too. Taylor Swift’s shows are not happening until late summer. I should have a right to resell those tickets.”

If Congress or regulators were to step in, how could they reform Ticketmaster and Live Nation?

There’s some precedent for ticketing legislation, like the 2016 BOTS Act, which authorized the Federal Trade Commission to levy fines for automated ticket scalping. In 2019, the DOJ extended Live Nation and Ticketmaster’s consent decree by 5½ years, mandating they “may not threaten to withhold concerts from a venue if the venue chooses a ticketer other than Ticketmaster.”

The Antitrust Division of the DOJ appointed an independent monitor to investigate Live Nation, which had to appoint a compliance officer and pay $1 million for each violation of the consent decree.

“Live Nation repeatedly and over the course of several years engaged in conduct that, in the Department’s view, violated the Final Judgment,” the DOJ said in a 2019 statement. “The Department will not tolerate transgressions that hurt the American consumer.”

Live Nation has been repeatedly accused of failing to follow industry protocols for keeping concertgoers and performers safe, according to a Times review.

Live Nation Entertainment is already under extensive scrutiny after the multiple fatalities at two Live Nation-produced events, Astroworld and Once Upon a Time in L.A., with hundreds of plaintiffs suing for wrongful deaths and injuries. Industry and regulatory experts agree that, whatever the synergies, Live Nation and Ticketmaster wield outsized power across live music.

Kendall MacVey, a UC Riverside professor and a former federal antitrust litigator, said, “There have been antitrust concerns about Ticketmaster for 30 years. Both people on the left and right agree on the need for more vigorous enforcement.”

The DOJ reportedly has opened a separate investigation into Live Nation, going beyond the terms of the consent decree.

“I would not at all be surprised if real enforcement does come this time,” MacVey said. “That could mean splitting Live Nation from Ticketmaster.”

Lina Khan, the chair of the Federal Trade Commission, which has rulemaking authority for consumer protection issues, has said that Ticketmaster is an example of a firm “becoming too big to care,” and that “I’m sure it’s top of mind for [DOJ].”

Such a move would create more openings for firms like AEG to competitively bid for shows. That would be a benefit in itself, Waksman said. “It’s not good for consumers or the industry to have so much power tied up in one company,” he added. “Live Nation has never been open about the range of effects they have had on the industry.”

Randy Phillips, former CEO of AEG Live, said that, while the DOJ’s consent decree prohibits monopolistic behavior, “There is supposed to be a wall between Ticketmaster and Live Nation, and most promoters don’t believe that exists.”

“When Live Nation owns and operates venues, promotes the show and manages the artist that sets the service fees, you’re not going to see a lot of pushback,” Budnick said. “If you’re a venue going with Ticketmaster, Live Nation brings more major tours your way.”

Breaking up the firm “would have a huge effect on Live Nation,” Lefsetz said. But it won’t fix everything. “Once you take Ticketmaster out, that still doesn’t solve the underlying problems around fees and exclusives. If Ticketmaster is a separate company, they’ll still be entitled to do all of that.”

Regulators could dilute Ticketmaster’s power by banning exclusive contracts for ticketing. That’s the case in much of the United Kingdom, where several companies can sell tickets to any given concert.

“In the U.S., unlike the U.K. and Europe, venues have five- to 10-year exclusive contracts with ticketing platforms like Ticketmaster,” Phillips said. “Advances to secure these contracts are revenue for the venue owners.”

Lefsetz agreed that ending exclusive deals is one obvious fix. “But say I own a building,” he adds. “Can the government just choose to take away that guaranteed revenue stream from me?”

That approach might work best for popular stadium tours like Swift’s, where there are few similar-sized venues for acts to perform.

“Taylor said, ‘I didn’t have many alternatives, I had to play these venues in big cities,’ and that’s where Ticketmaster’s market power manifests,” Budish, the economist, said. “If you want, you should be allowed to play SoFi for $50 a ticket and have no resale market. So if you can’t do that, why? There is a public utility aspect to those venues. Being able to play there at a price you want to set should be an option.”

The ultimate problem may just be the fact that many more people want to see Taylor Swift than there are seats available on her tour, which comes to SoFi Stadium for five nights in August. There are likely no fixes beyond raising prices, adding more dates or shutting off secondary markets.

Acts like Springsteen or the Rolling Stones curtail demand with extremely expensive tickets that their baby boomer fans are happy to pay for. Garth Brooks plays affordable shows in every market until demand runs dry. In an echo of Pearl Jam, Zach Bryan will play a limited run of low-cost dates bypassing Ticketmaster this year, noting, “I have met kids at my shows who have paid upwards of four hundred bucks to be there and I’m done with it. ... I’ve done all I can to make prices as cheap as possible and to prove to people tickets don’t have to cost $450 to see a good and honest show.”

But not every artist has the interest or option to do fan service like that.

“Taylor could go Garth mode and play as many shows as there’s demand for,” said Budish, “but then she’d be on the road for 10 years.”

Budnick agreed. “It’s heartbreaking, because you have an intimate relationship with Taylor, she’s the soundtrack to your life. But unfortunately, unless Taylor plays 500 stadium shows, people have to adjust expectations a little bit.”

Even venues that try to quit Ticketmaster may find it’s not so easy to leave. Last week, Brooklyn’s Barclays Center (home of the NBA’s Brooklyn Nets and arena-sized concerts) ended a seven-year deal with SeatGeek one year into the contract, to partner up with its old vendor: Ticketmaster.

Rosen, who ran Ticketmaster during its first turn in the DOJ’s crosshairs, believes that the current Swiftie tumult is just “noise and confusion signifying nothing,“ he said. “You’ve got to take the government seriously, but they could have brought a case in ’94 and didn’t. That class-action suit is all bull—. It will all end with nothing changed, because that’s not what the issues are.

“If someone has better tech and pays artists more, they’ll dislodge Ticketmaster as the premier service in the U.S.,” he said. “And when that happens, prices will go up, not down. None of this can be regulated because you can’t regulate emotions about a star. Why do people need to sit in the last 10 rows freezing in the rain? Because they need to be in the building.”

Watch L.A. Times Today at 7 p.m. on Spectrum News 1 on Channel 1 or live stream on the Spectrum News App. Palos Verdes Peninsula and Orange County viewers can watch on Cox Systems on channel 99.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.