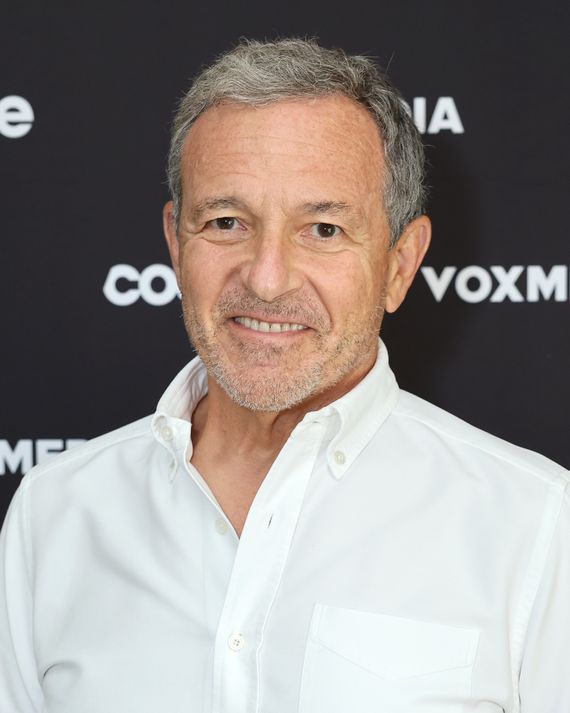

It’s been less than 72 hours since Disney’s board of directors announced it had fired CEO Bob Chapek and replaced him with his predecessor, Bob Iger. In the immediate aftermath of the bombshell, media reporters struggled to find new variations of the word “stunning” to describe just how big and shocking the news was. Even now, three days later, folks in Hollywood are still trying to wrap their heads around what it will all mean for one of the world’s biggest entertainment conglomerates.

Iger has already made one huge move, pushing out Kareem Daniel, the exec Chapek had basically put in charge of Disney’s streaming business. He also sent a memo to staffers saying he plans to dismantle, or at least radically rethink, the Disney Media and Entertainment Distribution unit that had been led by Daniel. Chapek created DMED as a way of taking budgeting power away from creative execs and putting it in the hands of number-crunchers and data analysts. Few Disney execs are likely to mourn its passing, but there isn’t going to be much time to celebrate in the weeks ahead. Iger is returning to Disney at a time when the company’s stock has taken a major hit and Wall Street has soured on streaming — or, to be more precise, the idea that streaming can effectively replace the beleaguered businesses of linear TV and theatrical distribution.

While Chapek’s leadership skills (or lack thereof) may have been what did him in, the fact that Disney is facing so much turbulence three years after the launch of Disney+ is a big reason why the board felt it needed to beg Iger to come back. Whatever one thinks of how Iger shaped Disney during his final few years as CEO, he clearly knows the company as well as anyone else, and he remains one of Hollywood’s most respected figures (something that could come in handy next year as the industry faces the very real possibility of a strike by the Writers Guild). There are many, many items on Iger’s agenda, but since this is a newsletter devoted to streaming and the TV business, this week’s edition is focused on what phase two of the BICU (Bob Iger corporate universe) might mean to those areas of his agenda. Here are three of the biggest questions facing the company as Iger dives back into battle against Netflix, HBO Max, and Disney’s many other streaming rivals.

➽ Does Iger go wobbly on his streaming-centric worldview?

August 8, 2017, is a date that will live in infamy whenever the definitive history of the streaming wars is written. That’s when Iger shocked Hollywood (and Wall Street) by announcing plans to pull Disney’s biggest movie franchises from Netflix and instead use them as the central building blocks of the company’s own streaming service. It was the birth of Disney’s Iger-imagineered pivot to subscription-based streaming, a strategy that on one level has been a smashing success: Anchored by Disney+, the company now has more than 235 million global streaming subscribers spread across its various digital platforms— even more than Netflix. Given that, there’s no way Iger is going to have Disney back away from its streaming über alles philosophy, right? Well, it depends on what your definition of “backing away” is.

It seems unlikely, for example, that Iger is going to suddenly pull a David Zaslav and start trash-talking the whole streaming business and declare that, no, actually, Disney doesn’t need to keep all of its best IP for itself and should focus more energy on selling its shows and movies to competitors. It was barely ten months ago, after all, that Iger once again publicly defended his 2017 move in an interview with Kara Swisher. “Disney was licensing movies to Netflix … and I woke up one day and thought, we’re basically selling nuclear weapons technology to a Third World country, and now they’re using it against us,” he said back in January. “So we decided at the time that we would stop licensing to Netflix and do it ourselves. And it resulted in a substantial decrease in our revenue, because we weaned ourselves off all that licensing. But it thrust us into a business that is the most compelling growth engine in the media today.”

Of course, not long after Iger made those remarks in January, Wall Street seemingly had a complete change of heart in how it measures success in streaming. Whereas subscriber numbers were once of paramount importance, investors are now demanding to see profits, which is why Netflix’s stock price collapsed this spring (though it’s since recovered a bit) and why Chapek now finds himself out of a job. Even if Iger remains philosophically committed to the centrality of streaming in Disney’s future, it is hardly a given he won’t start making some significant adjustments to the strategy.

What Disney needs most right now is to stop losing as much money on streaming as it has been: Its direct-to-consumer division shed $1.5 billion during the most recent quarter. Iger can (and probably will) find ways to cut costs, very likely by continuing Chapek’s announced plan to begin laying off staff. But one industry insider I spoke to believes he might also be able to raise some fast cash by reopening the Disney vault to some of its competitors — even Netflix. “Disney was making close to a billion dollars every year licensing their library outside of their own ecosystem,” an exec at a rival streamer told me.

This suit doesn’t argue with the logic of Iger’s 2017 decision to bring that content back home. “When you say, ‘Hey, it’s all in one place,’ it’s a great value proposition for consumers,” he says. But now that Disney+ is so much more established, “Whoever was going to sign up for that library already has.” The exec wonders whether it now might be okay for Iger to be less dogmatic about exclusivity: “That’s the first decision Bob has to make: Does he license the library?” Though it’s hardly a given, this exec believes Netflix would “probably pay for” big Disney movies if offered the opportunity, and that it might not cause that much pain to Disney+ — at least relative to some other options. “You can either start to ease up on the originals or you can go have the library do some work for you,” he explains, adding it’s possible Iger gets to a point where he says, “‘Well, it doesn’t hurt us if 20 percent of the library isn’t on Disney+.’”

Another option, albeit less lucrative, would be to license a package of Disney movies on a nonexclusive basis, which means Disney+ subscribers wouldn’t feel they were suddenly getting less value from their subscriptions. He could do something similar with some TV workhorses: Shows like The Simpsons and Family Guy already air on linear networks owned by rivals; why not strike a deal to have them also stream on another platform willing to shell out for them? Iger could also get more aggressive about windowing content, perhaps with non-blockbuster titles from less high-profile Disney brands such as Searchlight Pictures: Instead of having those films automatically go first to Hulu or Disney+, a newer platform might pay for the privilege of having them first for a few months.

➽ Does Iger ditch ABC and ESPN?

Assuming Iger hasn’t budged much in his belief that streaming is the key to Disney’s future, he could opt to make even more dramatic changes in the company’s portfolio of linear networks. In another Swisher interview this year — a September appearance at Vox’s final Code Conference — Iger made it clear he thought broadcast and cable networks were not going to hang on. “Linear TV is marching towards a great precipice and it will be pushed off,” he said. “I can’t tell you when, but it goes away.” This might not be a new opinion for Iger, but now that he’s back in charge of Disney, it could well inform how he handles its biggest linear platforms, most notably ABC and ESPN.

LightShed’s Rich Greenfield, a longtime traditional-TV bear, wasted no time this week calling for Iger to be decisive. “Iger’s first decision must be what assets he believes are core to Disney’s future,” Greenfield wrote in a note to clients. “We hope to see Iger take swift action to separate out ESPN and ABC … At the very least, we believe both ESPN and ABC should undergo significant cost reductions.” Analyst Michael Nathanson of MoffettNathanson made a similar argument Tuesday in a note to investors, arguing that ESPN simply can’t keep paying exorbitant amounts for NBA and NFL rights. “We would expect deep cost-cutting at ESPN, which should include a review of all of the upcoming sports rights in order to more adroitly adapt to these new times,” he wrote.

Greenfield’s idea of spinning off ESPN entirely seems far from certain, given how much Disney has invested in sports — though these days, I don’t think anything is out of the question. Dumping ABC right now also seems like a stretch, when you think about how much benefit Disney derives from using it as a platform to promote its streaming services and its parks business. (ABC can also be a great incubator for streaming hits, as evidenced by Abbott Elementary.) Disney’s local-TV-station business also makes a ton of money, thanks to ever-increasing spending on political ads. But Iger has a long history of bold moves, and if he can figure out a way to keep the good parts of owning linear networks without having to continue to invest money in what he sees as a dying medium, then it’s not inconceivable there’s a big change here over the next few years. What seems more certain is that Greenfield and Nathanson will get their wishes for “cost reductions.” Chapek was already signaling such a path, and insiders at Paramount Global and Comcast’s NBCUniversal are already preparing for more pain in the weeks ahead as well.

➽ What happens with Hulu?

As part of a deal struck when Iger was still at Disney, Comcast has the right to sell off its one-third stake in Disney-run Hulu as soon as 2024. Most industry insiders figured it was a no-brainer that Disney would want to do this sooner rather than later, assuming it could agree on how much Comcast’s stake in Hulu is worth. Hulu has been going gangbusters on the content front of late, and it has become a key part of Disney’s bundle strategy. But Greenfield, as he has for some time now, is once again arguing what Iger should actually do is get rid of Hulu altogether. “We would try to sell Disney’s two-thirds stake in Hulu to Comcast but keep the most important Disney-owned Hulu programming, and migrate ABC content to Disney+ exclusively over the next couple of years,” he wrote this week in the wake of Iger’s return.

I don’t pretend to know what Iger will do here. The fact that Disney basically already blends most Hulu content into Disney+ elsewhere around the world perhaps indicates the company could do something similar here, and doesn’t really need a stand-alone Hulu. But I also think there’s value in letter consumers who want to pay less if they prefer only Hulu or Disney+. Plus, why give Comcast the ability to better compete against Disney by giving it access to the superior tech platform that is Hulu, or the 15 years of brand awareness? The immediate financial benefits don’t seem worth it in the big picture. On the other hand, given how much Wall Street is clamoring for improvement in Disney’s balance sheet ASAP, Iger might not have the luxury of thinking only about the long-term.