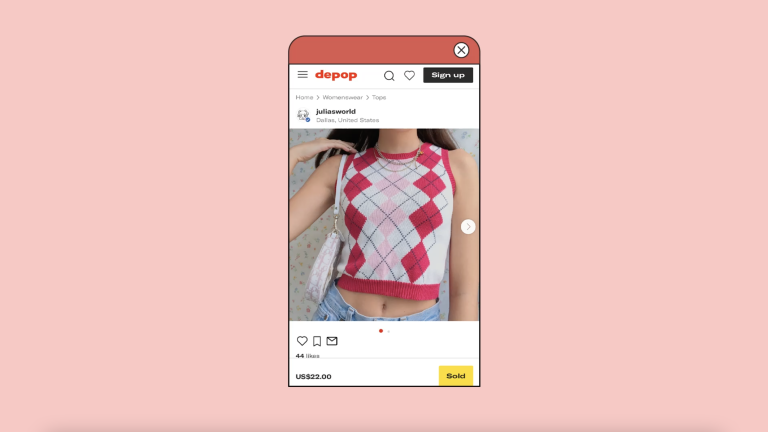

Last year, Julia King, a 20-year-old art student and influencer from Texas, noticed that a particular kind of sweater vest was taking over the internet. Celebrities like Bella Hadid had been photographed wearing shrunken argyle-patterned styles, channeling classic ’90s movies like Clueless during a wave of millennium-era nostalgia. Soon, King found the perfect example in a thrift store: a child-sized pink and red knit vest that fit tight and cropped on an adult. Using herself as a model, King paired it with jeans and a Dior bag, snapped a picture, and listed it for $22 on Depop, an eBay-like resellers’ app favored by Gen Z.

The vest sold instantly, and she quickly forgot about it. But a month or so later, King received a message from one of her Instagram followers. They alerted her that an obscure, now-defunct Chinese shopping site called Preguy was using her photo to sell its own cheap reproduction of the thrifted vest. “Seeing the pictures of me up on some random fast-fashion website I’d never heard of before made me really upset,” King said.

Replicas of the vest soon began popping up on countless other clothing sites and e-commerce marketplaces, including Amazon, AliExpress, Walmart, and Shein. Over time, the image of King’s torso would be altered, warping her body shape; at one point, another person’s manicured hand was awkwardly photoshopped onto it.

Eventually, retailers began using their own product photos, but that didn’t make the experience any less surreal. Unknown brands with names like GadgetVLot and WEANIA marketed their versions of the vest with jumbled strings of keywords: “Autumn Preppy Style Streetwear Clothes,” “Plaid Cotton Knitted Vest Elastic V-neck Sweater Crop.”

A vest that had started as a one-off thrift find was now available for anyone to purchase, and often for an even lower price. As with many fashion trends, it had been plucked from social media and dropped into the frenzied machine of the global e-commerce market. It was multiplying, almost of its own accord, in the factories of China’s swelling ultra-fast-fashion industry.

Over the past decade, thousands of Chinese clothing manufacturers have begun selling directly to international consumers online, bypassing retailers that traditionally sourced their products from the country. Equipped with English-language social media profiles, Amazon seller accounts, and access to nimble garment supply chains, they’ve fueled the acceleration of trends and flooded closets everywhere with a wave of impossibly cheap clothes.

Rest of World spent the last six months investigating this new ecosystem, speaking with manufacturers, collecting social media and product data, making test buys, and interviewing shoppers and industry experts in both China and the U.S. Our reporting reveals how Chinese apparel makers have evolved to cater to the desires of internet-native consumers — and transformed their consumption habits in the process. Capitalizing on this shift are companies like Shein: the most successful, well-known, and well-funded online retailer of its kind.

Shein is now one of the world’s largest fashion companies, but little is known about its origins.

It was founded in 2012 under the name SheInside, and reportedly began by selling wedding dresses abroad from its first headquarters in the Chinese city of Nanjing. (A spokesperson for Shein denied it ever sold wedding dresses, but declined to specify other details about its history.) The company says its founder, Chris Xu, was born in China, though a since-deleted press release described him as from the U.S.

Shein eventually expanded to offer apparel for women, men, and children, as well as everything from home goods to pet supplies, but its core business remains selling clothes targeted at women in their teens and 20s — a generation who grew up exploring their personal style on platforms like Instagram and Pinterest.

Its clothes aren’t intended for Chinese customers, but are destined for export. In May, the company became the most popular shopping app in the U.S. on both Android and iOS, and, the same month, topped the iOS rankings in over 50 other countries. It’s the second most popular fashion website worldwide.

By 2020, Shein’s sales had risen to $10 billion, a 250% jump from the year before, according to Bloomberg. In June, the company accounted for 28% of all fast fashion sales in the U.S. — almost as much as both H&M and Zara combined. The same month, a report circulated that Shein was worth over $47 billion, making it one of the tech industry’s most valuable private startups. (Shein declined to say whether the sales or valuation figures were accurate.)

Shein’s fast growth has brought with it a series of controversies. Numerous designers accused it of stealing their work, and brands like Levi Strauss and Dr. Martens sued the company for trademark infringement. (The former later settled for an undisclosed sum, while Shein said it doesn’t comment on ongoing litigation). It was also skewered for selling culturally or historically offensive products, like swastika necklaces. Most notably, advocacy groups and journalists have uncovered evidence that Shein’s $11 bikinis and $7 crop tops were being made by people working under brutal conditions, while environmental experts warned those same items were often only being worn once before getting thrown away.

At the heart of these issues is Shein’s aggressive business model. Comparisons to fast-fashion giants like H&M miss the point: it’s more like Amazon, operating a sprawling online marketplace that brings together around 6,000 Chinese clothing factories. It unites them with proprietary internal management software that collects near-instant feedback about which items are hits or misses, allowing Shein to order new inventory virtually on demand. Designs are commissioned through the software; some original, others picked from the factories’ existing products. A polished advertising operation is layered over the top, run from Shein’s head offices in Guangzhou.

Through its manufacturing partners on the ground in China, Shein churns out and tests thousands of different items simultaneously. Between July and December of 2021, it added anywhere between 2,000 and 10,000 SKUs — stock keeping units, or individual styles — to its app each day, according to data collected by Rest of World. The company confirmed it starts by ordering a small batch of each garment, often a few dozen pieces, and then waits to see how buyers respond. If the cropped sweater vest is a hit, Shein orders more. It calls the system a “large-scale automated test and re-order (LATR) model.”

“Fast fashion is well-known for its very frequent replenishment of products,” said Sheng Lu, a professor at the University of Delaware studying the global textile and apparel industry. “But Shein is totally different.” From January to October of 2021, Lu’s research found the company offered more than 20 times as many new items as Zara and H&M.

Factbox

| COMPANY NAME: | Shein |

| CEO: | Xu Yangtian |

| HEADQUARTERS: | Guangzhou, China |

| FOUNDING YEAR: | 2012 |

| AVERAGE # OF DAILY NEW ITEMS THIS MONTH: | 7,512 |

| % SHARE OF U.S. FAST FASHION MARKET: | 28% |

| INVENTORY PRODUCTION TIME: | 30 days |

| KEY INVESTORS: | Tiger Global, JAFCO Asia, IDG Capital, Sequoia China |

| CURRENT EST. VALUATION: | $15 – 47 billion |

Amazon’s activity in China may have inadvertently contributed to Shein’s success. Starting around 2013, the e-commerce giant began aggressively recruiting manufacturers in the country to sell cheap products abroad on its third-party marketplace. As Chinese sellers joined the platform, Western consumers were flooded with thousands of new brands selling basic goods from kitchen supplies to electronics chargers under unfamiliar names like Nertpow, FRETREE, and BSTOEM.

Amazon gave these factories the enormous opportunity to cut out Western middlemen and begin learning about the tastes of American shoppers. In turn, Amazon was able to undercut the prices of its competitors, and by 2020, 40% of its third-party sellers were based in China.

But the partnership between Amazon and Chinese manufacturers eventually began to sour. Customer complaints about counterfeits and dangerous products from China were putting a dent in the tech company’s reputation, and this September, Amazon banned hundreds of Chinese merchants for allegedly using fake product reviews. Many of the sellers weren’t entirely happy with Amazon either, which required them to abide by an ever-shifting set of policies and pay hefty fees for services like warehousing and order fulfillment.

“This cost is very high,” said Du Tianchi, the founder of an apparel company in China’s Jiangsu province that sells on Amazon and AliExpress. “Once your Amazon storage is out of stock [in the U.S.], you have to replenish it from China, which is time-consuming.”

Rising frustration with Amazon among Chinese sellers opened a window for Shein, which recruited many of them to supply its own platform. But Shein didn’t just try to compete with Amazon: it joined it. The company offers thousands of its own products on Amazon’s marketplace, including some that have become bestsellers.

“Amazon whet the palate for online shopping, taught [Americans] how to shop online, and created the habit,” said Allison Malmsten, a China market analyst at Daxue Consulting in Hong Kong. “Shein realized that and decided to optimize it.”

Rather than mimicking Amazon directly, Shein grew by bringing traits of China’s gamified e-commerce market to the rest of the world. Online shopping in the country has evolved into a form of entertainment, featuring livestreamers, flash sales, and enticing pop-ups that compel consumers to scroll through the newest products. Taobao, a domestic Chinese e-commerce platform owned by Alibaba, helped pioneer interactive features like custom product recommendations and even built a mini–social network into its app. Shein has used similar components on its platform, including a points system that rewards shoppers for making purchases, leaving reviews, and playing minigames.

Malmsten said that Shein has learned a lot from the strategies of Chinese e-commerce companies. “Shein brought that style [of shopping] to the West, and it really works with Gen Z,” she said.

After watching the company’s rapid rise, major Chinese tech giants and newer startups are now racing to imitate it. The competition includes ByteDance and Alibaba, which are both working on e-commerce platforms targeting the same international demographic as Shein. Then there are brands like Cider, a Hong Kong–based e-commerce clothing brand backed by the legendary venture capital firm Andreessen Horowitz. In a blog post announcing its investment, the firm described Cider as a “marketplace of global factories that makes it possible for users to have more selection than Zara, at the price point of Forever 21, on-demand.”

Lin Zhen is a Chinese clothing manufacturer and the head of the largest organization of Amazon sellers in Fujian, one of China’s main garment-producing provinces. He has sold clothing to consumers in Europe and North America directly since 2011, long before they learned to buy everything from mattresses to toothpaste on Instagram. Today, Lin’s clothing company, Xiamen Ouchengsheng, known as OCS, earns nearly $100 million in annual overseas sales, he told Rest of World. This year, about half came from Amazon, a third from the company’s website, and the rest came through AliExpress or selling to other businesses, including Shein.

Lin said that Shein originally approached OCS because it was one of the top sellers of dresses on AliExpress, Alibaba’s e-commerce platform for markets outside China. Lin said that the company mandated that he produce a certain number of different styles every month, and deliver some in as fast as 10 days. “The requirements are kind of high,” he said.

Because of the variety of styles Shein demands, suppliers that already have a range of production capabilities and function “more like factories” have an easier time working with the company, Lin explained.

“Shein just kind of blew Zara out of the water.”

Lin said he feels positive about what Shein has done for Chinese apparel sellers. The company’s ability to persevere through a number of challenges — worsening tensions between the U.S. and China, global supply chain slowdowns, and an ongoing pandemic — is a result of a “long-term vision” that has included “meticulous supply chain management,” he told Rest of World.

The secret is Shein’s internal software, which connects its entire business from design to delivery. “Everything is optimized with big data,” Lin said. Each of Shein’s suppliers gets their own account on the platform, which spits out information about what styles are selling well and can also quickly identify which might become future hits. “You can see the current sales, and then it will tell you to stock up more if you sell well and what you need to do if you don’t sell well. It’s all there.”

The software contains simple design specifications that help manufacturers execute new orders quickly. “A big brand might need a very high-end designer, or a designer with top technology, and even then may only be able to produce 20 or 30 styles a month,” said Lin. “But Shein does not have high design requirements. It is possible that a typical university student could get started designing quickly, and the output could be high.”

A spokesperson for Shein declined to say much about the software, but said the company invests “heavily in training, technology, and IT support to help our suppliers become more efficient and profitable.”

For years, European brands like Zara and H&M have embodied fast fashion, shortening the route from runway to storefront from months to weeks. But Shein isn’t chasing runway trends — rather, it often knocks off items seen on TikTok and Instagram, where hype cycles move significantly faster. Whereas Zara typically asks manufacturers to turn around minimum orders of 2,000 items in 30 days, Shein asks for as few as 100 products in as little as 10 days. “They want factories to be much more nimble,” said Lu.

That pressure to produce clothes more rapidly ends up falling on Chinese garment workers, who sew products for Shein during long shifts in poorly regulated workshops, according to reporting by the Chinese media site Sixth Tone. A knitting machine operator at a factory in the city of Zhejiang told Rest of World that, in China’s garment sector, working overtime is “a certainty.”

“Like all the manufacturing industries in China, the number of employees working overtime is, basically, already saturated,” said the worker, who asked to remain anonymous because they weren’t authorized to speak about their job publicly. “It’s impossible to go to work from nine to five.” (The factory where they work doesn’t supply for Shein, but does manufacture clothes for other foreign brands and for sale on AliExpress.)

In emailed comments, Shein said the company takes “all supply chain matters seriously and is fully committed to upholding high labor standards.” It added that it takes “immediate action” if it identifies that a supplier isn’t adhering to its code of conduct.

Shein’s software-driven model allows it to remain at arm’s length from the labor force actually making the products on its platform. It can also avoid directly managing inventory for almost any of the products it sells, minimizing the amount of goods sitting unbought in warehouses.

To convince suppliers to join its system, Shein had to meet only a very basic bar: paying them on time. Receiving timely payments is a huge problem for factories in China, said Malmsten. “They’ve built a lot of loyalty from their suppliers, so they can have more urgency on their orders,” she said. The result is that over 70% of products on Shein’s website were listed less than three months ago, Malmsten found, compared to 53% at Zara and 40% at H&M. “Shein just kind of blew Zara out of the water,” she said.

There is a downside to Shein working with so many different factories at the same time: similar products are leaking all over the internet. Because some suppliers like Lin sell through multiple channels, consumers have complained on social media about seeing the same clothes appear on Shein, AliExpress, Amazon, and stand-alone e-commerce sites, all at different prices. The duplicated products are often brandless basics, like T-shirts, or otherwise knockoffs of items from independent labels and major fashion houses. Since they don’t seem exclusive or unique, consumers are wary about getting duped into paying more than they should.

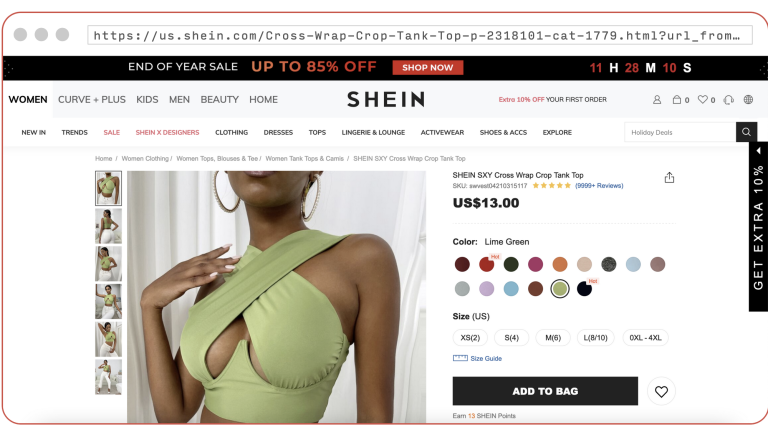

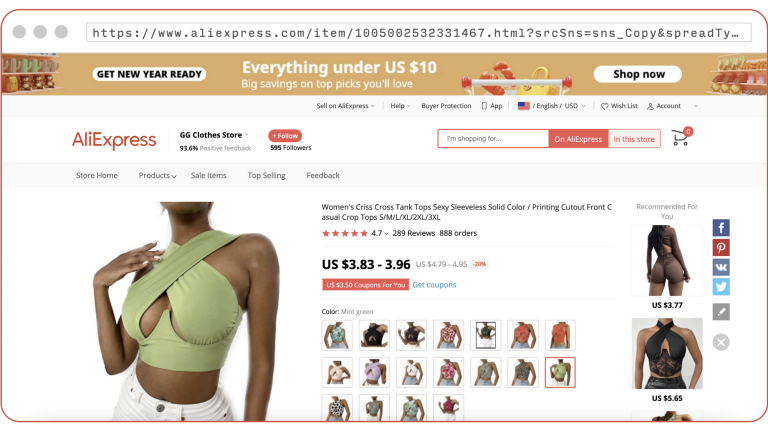

Communities have sprung up on TikTok, Reddit, and Facebook where shoppers share tips about how to find identical-looking clothes for half the price or how to buy a convincing “dupe” (a copycat version) of this season’s hottest designer handbag. Over the summer, when a roughly $16 criss-cross crop top from Amazon went viral, TikTok users began pointing out that it was available for only $13 on Shein and as low as $3.83 on AliExpress.

"They’re spending truckloads of money trying to capture consumers who are searching for products."

These forums are the natural outcome of an online shopping ecosystem that has made international consumers more aware of the Chinese companies making their clothes. Because they know the bulk of what they buy is coming from China, many people, understandably, assume that similar items originated from the same factories. While that can be the case, test buys conducted by Rest of World suggest that the environment is more complicated.

In September 2021, we ordered five clothing pieces from different shopping sites — Cider, Shein, and Amazon, as well as the online brands Halara and Shop-Pêche. We also bought what looked like imitations of the same products on AliExpress. We found that, while the items were often extremely similar, most weren’t carbon copies. This suggests that while some suppliers are offering the same products on multiple websites, apparel factories in China are also extremely adept at mimicking one another and adapting to the same trends.

“Many of these companies are leveraging data to forecast what items they should produce,” said Lu, from the University of Delaware. “If you use the same data inputs, and you’re using the same algorithm, maybe the outcome is also very similar — if not exactly the same.”

“At many of these companies these days, including, I suspect, at Shein, it’s not the fashion guys that are designing clothing,” he said. “It’s engineers. Engineers looking at data.”

Among the test buys were two sweater vests, both marketed using Julia King’s Depop photo: one from Amazon, one from AliExpress. While constructed in the same way, one was more candy apple in color, the other a more burgundy tone. There were similar shade differences, subtle but noticeable, between two cherry-print cardigans from Shein and AliExpress. Heart-print jeans from Cider and AliExpress differed in material and stitching. But a pair of yellow platform clogs from Shop-Pêche — a clothing brand whose website says it was founded in New York — were indistinguishable from their AliExpress equivalent.

In an environment where the competition can rapidly copy your products, a company is set apart by its marketing. Shein has poured significant funds into Google and Facebook advertising campaigns, influencer deals, and even its own social-media reality show co-hosted by Khloe Kardashian. “They’re spending truckloads of money trying to capture consumers who are searching for products,” said Cooper Smith, an e-commerce and fashion industry analyst who previously worked as the head of Amazon intelligence at Gartner.

Shein’s approach appears to be paying off: In August, its website had 150 million visitors, 40% of whom came via search, according to Similarweb, compared to 4% of Zara’s. On social media, the company has partnered with countless micro-celebrities, fashion bloggers, and contestants from reality shows like The Bachelor, who show off deliveries of trendy clothes in “haul” videos posted to TikTok and Instagram. Before Shein’s app was banned by the Indian government last year, the company was at one time reportedly working with roughly 2,000 influencers in the country alone.

“They’ve been really smart in understanding their Gen Z customers and the types of content that they resonate with,” said Emily Trenouth, head of influencer marketing at the agency MediaCom.

The Shein model has firmly established a new norm. Alongside that is a growing question: Is it a norm that the clothing industry wants?

The company has become a poster child for the energy-intensive fast fashion sector, which has become notorious for making goods with hazardous chemicals that quickly end up in landfills and oceans. In November, Shein appointed a global head of environmental and social governance, and the company told Rest of World it has put in place “water and waste management systems within its supply chain,” and is working on an “expanded strategy.”

It’s not clear how long ultra-fast-fashion’s environmental impact can be ignored. Several experts who spoke to Rest of World expressed concerns about the model’s long-term prospects. “Do we really need more companies like Shein? Is this really an exciting business model to celebrate?” said Lu.

But new and well-resourced rivals are watching, and following close behind. In October, Alibaba — which pioneered the Taobao-style of shopping that Shein originally learned from — launched its own shopping site for North America and Europe, called AllyLikes. It appears to be a mirror image of Shein, except with far fewer items for sale and a negligible number of reviews.

Rui Ma, founder of the investment consulting firm Tech Buzz China and contributing columnist for Rest of World, said that Alibaba could leverage its existing e-commerce expertise for the project, but it’s not clear how much it will be prioritized. ByteDance, meanwhile, is hiring for dozens of jobs related to international e-commerce, and a crop of other Chinese firms are trying to claim their own slice of the market too.

The activity implies that the cycle of ultra-fast-fashion will only keep ticking up in speed and volume, as long as consumers continue to willingly buy into micro-trends — and discard them just as quickly.

“We’re already in this race to the cheapest product, and the number of products just goes up,” said Elizabeth Shobert, vice president of marketing and digital strategy at the e-commerce analytics firm StyleSage. “I just keep thinking: Where does this end?”