There’s plenty about 5G we don’t know, like the specific service plans U.S. carriers intend to offer this year and what exactly they’re going to offer. But we know a lot more about 5G than we did at last year’s Mobile World Congress Americas (MWCA) when it was held in San Francisco.

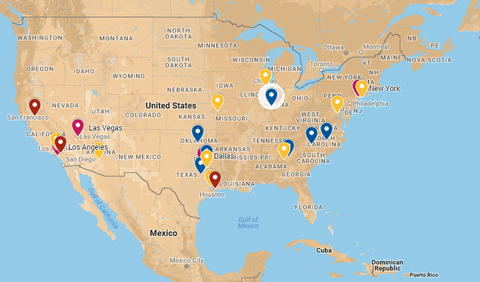

Click here for the interactive map or

scroll down to view on this page.

(Google Maps/FierceWireless)

AT&T is poised to introduce mobile 5G service in 12 cities by the end of this year and it has announced some of them. Verizon is launching a fixed wireless access (FWA) service in four markets before year’s end: Sacramento, Los Angeles, Houston and Indianapolis. T-Mobile and Sprint are intent on making their merger work and are pinning much of their arguments on 5G, saying they’ll better compete as a combined entity than apart.

Here are a few other things we know about 5G as the industry heads into the second annual MWCA, to be held Sept. 12-14 in Los Angeles.

Real 5G smartphones are not expected to arrive until 2019

Devices for mobile hotspots or mobile data cards are expected to launch in 2018, but 5G smartphones are not going to be arriving until the first half of 2019 despite a great deal of pressure to make it happen before that.

For its mobile 5G, AT&T has said it plans to offer a “puck” type of device. Not to be outdone, Verizon announced exclusive availability of the moto z3, dubbed the first 5G-upgradeable smartphone that comes with a moto “mod” clip-on, a magnetic attachment that will enable the phone to access the carrier’s 5G network next year.

Qualcomm announced earlier this year that more than a dozen handset makers around the world have selected its Snapdragon X50 5G NR modem to power their forthcoming 5G phones. Specifically, Asus, HMD Global, HTC, LG, Oppo, Sharp, Sierra Wireless, Sony Mobile, vivo, Inseego/Novatel Wireless, Xiaomi and ZTE were among those confirmed to be using Qualcomm’s Snapdragon X50 5G NR modem.

More recently, Sprint and LG announced they’re building a 5G phone that the companies believe will be the nation’s first mobile 5G smartphone. They said the phone would be available in the first half of next year, launching in conjunction with Sprint’s 5G network. The companies didn’t offer much in the way of details, including how much the phone would cost or its features. They also wouldn’t provide details on Sprint’s forthcoming 5G service, including what it might cost.

Speed, latency will be key

Speed and latency are often associated with 5G, and for good reason. Verizon has said it can offer 1 Gbps internet connections in 28 GHz beyond 2,000 feet. AT&T has observed more than 1 Gbps speeds under line of sight conditions up to 900 feet—that’s equal to the length of three football fields.

T-Mobile has said it will deliver fiber-like speeds averaging a blazing 444 Mbps, with peak speeds up to 4.1 Gbps. By 2021, CEO John Legere promises, its engineers will deliver 5G speeds five times faster than the LTE speeds that are delivered today. Meanwhile, Sprint continues to improve upon its network, including through the deployment of Massive MIMO radios, a key bridge technology to 5G.

5G also promises to provide near-zero latency with high reliability for mission-critical applications. Called ultra-reliable low latency communication (URLLC), it has the potential to change how factories operate, how surgeons work remotely and how cars are driven. In addition, 5G’s low latency will provide the kinds of experiences that will enable people to use virtual reality (VR) goggles and not feel nauseated. That has implications for entertainment and gaming industries, too.

Vendors are raring to go

Of course, the usual suspects Ericsson and Nokia are supplying 5G gear in the U.S., as well as relative newcomer Samsung. Qualcomm has been leading the charge from a chipset solution perspective, as well as scores of other vendors in components and other areas. And unlike previous generations of cellular technology, Intel has been humming the 5G tune from the get-go, contributing to standards and showing up at high-profile events like the Winter Olympics in South Korea earlier this year.

Interestingly, Ericsson appears to be leading in 5G over rival Nokia in the North American mobile infrastructure market. Dell'Oro Group earlier this year said Ericsson had widened its lead over Nokia during the first quarter.

Spectrum, spectrum, spectrum

The U.S. wireless industry always has had a pretty enormous appetite for spectrum—although some auctions and secondary market transactions have fared better than others. While millimeter wave has been strongly associated with 5G—it provides a lot more capacity than other bands—operators will be using low, mid- and high-band spectrum for 5G.

Before announcing its merger plans with Sprint, T-Mobile touted how it was well positioned to deliver a 5G network with low, mid- and high-band spectrum, including the 600 MHz that it acquired in the incentive auction. Sprint also claims it is in a position to lead in 5G, with more than 160 MHz of 2.5 GHz spectrum in the top 100 markets.

But staying in character, operators are eager to get their hands on more spectrum, and the FCC has myriad proceedings underway to make more available. All of these bands are in some state of play: 2.5 GHz, 3.5 GHz, 3.7-4.2 GHz, 4.9 GHz, 5.9 GHz, 6 GHz, 12 GHz, 24 GHz, 26 GHz, 28 GHz, 32 GHz, 37 GHz, 39 GHz, 42 GHz, 47 GHz, 50 GHz and above 95 GHz.

First out of the gate will be the 28 GHz auction, scheduled to start Nov. 14, to be followed by the 24 GHz auction. In the second half of 2019, the 37, 39 and 47 GHz auction will take place. In the meantime, the FCC is still considering 3.5 GHz rule changes, as well as how it’s going to handle the other aforementioned bands.

Importantly, the FCC’s planned 28 GHz and 24 GHz spectrum auctions are critical because they represent the first time so-called millimeter wave (mmWave) spectrum will be publicly auctioned. The value of mmWave spectrum isn’t yet clear—the best estimate for the value of this spectrum comes from Verizon’s $3.1 billion purchase of Straight Path in 2017. Indeed, that purchase, and Verizon's earlier acquisition of XO, gave Verizon ownership of a big swath of the nation's 28 GHz spectrum, which is a big reason the FCC's upcoming 28 GHz auction isn't nationwide.

Coverage will not be everywhere and LTE is the fallback

Obviously, 5G is not going to be available everywhere in the U.S. on day one, and plenty of industry stakeholders have been deliberating how it will reach the more rural and remote regions of the country. 3GPP approved the non-stand-alone (NSA) version of 5G New Radio (NR) back in December 2017 and the stand-alone (SA) version in June 2018. Some operators will deploy both, but the NSA version uses LTE as an anchor.

Part of the fight over mid-band spectrum, most prominently the 3.5 GHz band, has been over which operators will have the best access to that spectrum when it’s licensed. Big operators want larger licensed areas and smaller WISPs that operate in largely rural parts of the country want census-tract-based licenses that they can better afford and build out.

While Verizon has identified its first four 5G markets for 2018 lift-off, AT&T’s initial 5G markets include a mix of highly urban markets like Atlanta and smaller markets like Waco, Texas. With Sprint, T-Mobile is promising to deliver 5G speeds in excess of 100 Mbps to roughly two-thirds of the population in just a few years and 90% of the country by 2024.

Before its proposed merger was announced, T-Mobile said its network vendors Ericsson and Nokia are going to build a 5G network across the carrier’s 600 MHz, 28 GHz and 39 GHz spectrum in 30 cities—including New York, Los Angeles, Dallas and Las Vegas—during 2018. However, it wasn’t expecting compatible smartphones until early 2019.

Earlier this year, Sprint also promised to launch mobile 5G services on its 2.5 GHz spectrum holdings on a nationwide basis in the first half of 2019, but its 5G position, as revealed in the Public Interest Statement supporting the merger, makes it clear that Sprint faces severe limitations in what it can achieve as a standalone company. Sprint’s biggest challenge in 5G is the same as it is for 4G LTE: It doesn’t have the low-band spectrum position that provides better propagation characteristics for coverage. Without decent coverage, Sprint suffers from the same quality-of-service issues that it has experienced from its early days as a PCS carrier.

Who’s winning the race depends on who you talk to—and not everyone agrees there is a global race

According to a study earlier this year by Analysys Mason, China held a narrow lead in overall 5G readiness ahead of South Korea and the United States. A more recent study from Juniper Research found that operators in Japan and South Korea are the clear leaders in the race to 5G. IHS Markit found that most of the mobile operators participating in its study were busy trialing and testing the technology, mainly in North America and Asia, with 12%—all from North America—planning commercial 5G rollouts by year’s end.

Why so many diverse answers? Surely part of it is how the question is phrased. In the U.S., Verizon has vowed to be first in the world with 5G—it’s 5G strategy starts with fixed wireless but will move to mobile next year. AT&T also plans to be first—but with a mobile 5G service in multiple markets.

In Japan, NTT DoCoMo’s goal has been to provide 5G for the 2020 Olympics. In China, operators are so huge—China Mobile alone services 887 million connections—that they can tie their 5G firsts to scale. And in South Korea, operators are pooling their efforts and sharing the costs of deploying a nationwide 5G network that will launch commercial services in March 2019.

Some analysts question that there’s any “race” at all. Most operators are rolling out networks that are based on 3GPP defined specifications, which the entire industry was involved in creating. Chinese operators don’t compete with U.S. operators for customers and it’s highly unlikely a U.S. citizen will move to China just to experience a better 5G service. Within the U.S., operators like Verizon are going to have to present a compelling price or service to persuade consumers to cut the cord with their current cable or other internet service provider.

Will there be glitches on the way to more widespread 5G commercialization? No doubt, but the industry continues to learn more about 5G every day and next week promises to reveal a lot more—including more "firsts."