Lithium-ion batteries were first introduced to the public in a Sony camcorder in 1991. Then they revolutionized our lives. The versatile batteries now power everything from tiny medical implants and smartphones to forklifts and expensive electric cars. And yet, lithium-ion technology still isn’t powerful enough to fully displace gasoline-powered cars or cheap enough to solve the big energy-storage problem of solar and wind power.

Dave Eaglesham, the CEO of Pellion Technologies, a Massachusetts-based startup, believes his company has made the leap beyond lithium-ion that will bring the battery industry to the next stage of technological disruption. He and his colleagues have accomplished something researchers have been struggling with for decades: they’ve built a reliable rechargeable lithium-metal battery.

Though other startups have for years made various claims about lithium-metal batteries, none yet have gotten past the development or testing phases; Pellion has already been selling their battery to at least one buyer since February.

Pellion’s battery can pack nearly double the energy of a conventional lithium-ion battery, making it able to, for example, double the time a drone can spend in the air. That 100% increase in energy density is a step change compared to the annual 10% or so improvement the battery industry currently averages. If Pellion overcomes early limitations, its batteries have the potential to power a Tesla car for 800 km (500 miles) on a single charge, rather than today’s upper limits of 400 km.

🌍 Quartz is running a series called The Race to Zero Emissions that explores the challenges and opportunities of energy-storage technologies. Sign up here to be the first to know when stories are published.

The story of a pivot

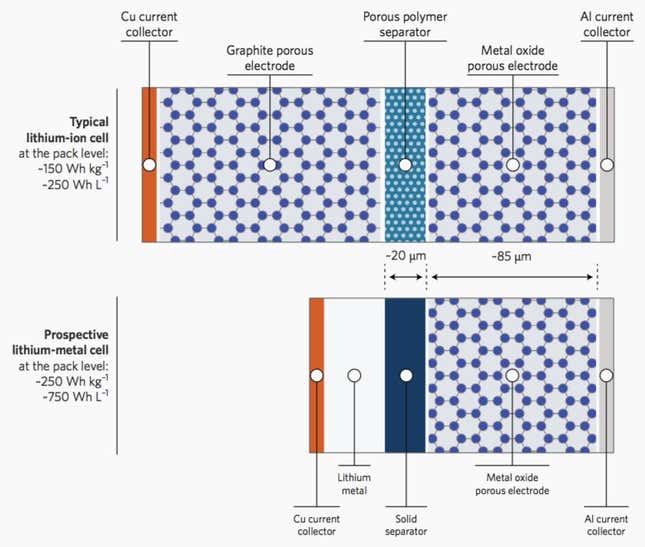

The lithium-ion battery is named for its use of charged atoms—also known as “ions”—of lithium. The ions shuttle between two electrodes (the anode and the cathode) as the battery is charged and discharged.

One of the limitations of this tech is that a lithium ion carries only a single positive charge. In theory, simply using magnesium ions—which carry two positive charges—would mean packing in a lot more energy in the battery. In 2011, Robert Doe, a postdoctoral student at MIT, and his then supervising professor Gerd Ceder, founded Pellion with the goal of building a magnesium-ion battery. Within two years, Pellion had a working prototype in the lab. But it had a lot of problems. Though the battery worked, it was no match for lithium-ion batteries on simple things like charging and discharging with consistency.

That’s when Eaglesham joined as CEO. “We had the world’s best magnesium battery, but I couldn’t see how to turn it into a compelling product,” he says. However, Eaglesham noticed that in the process of building a working prototype, Pellion had solved one of the industry’s long-standing challenges for rechargeable batteries: how to put a metal on the anode safely.

Energy-rich metals like lithium and magnesium tend to be highly reactive. And a complete battery, when packed with an energy-dense electrolyte, makes the system even more dangerous. Remember the exploding Samsung Galaxy Note 7?

That’s why typical lithium-ion batteries use anodes made of graphite, a form of carbon. But graphite anodes can only store one atom of lithium for every six atoms of carbon. Replace graphite with an anode made entirely of lithium atoms—aka a lithium-metal anode—and you’ve just saved a lot of space in your cell.

In a study published in January this year, Paul Albertus, a program director at the US Advanced Research Projects Agency–Energy (ARPA-E), used this graphic to show how dramatically more energy-dense a lithium-metal battery could be:

Eaglesham made the case to his new colleagues at Pellion that, if they’d found a way to use a metal anode safely, it would be better to pivot to lithium rather than struggle with magnesium. That way, they could take advantage of more than three decades of work done on lithium-ion technology to solve the little but important problems, such as charging consistency or voltage fluctuations, while still creating an energy-dense battery and moving the needle on innovation in the industry.

Trial by fire

Scientists have long understood that a lithium-metal anode would theoretically pack in more energy. In fact, the first lithium-ion cells that oil giant Exxon developed in the 1970s contained lithium-metal anodes. (Exxon was working on batteries then because it worried that oil might run out one day.) Single-use lithium-metal batteries were commercialized about the same time and they are used even today in specialized applications, such as deep-sea drilling.

Commercializing rechargeable lithium-metal batteries is a bigger challenge. In the 1980s, Moli Energy, a Canadian startup, was the first to succeed. But some of its batteries started catching fire, and the company had to issue a recall. The incident led to legal action and Moli Energy was forced to declare bankruptcy.

The use of lithium metal in rechargeable batteries creates three big problems. First, it reacts with everything: water, oxygen, and even nitrogen (all of which are present in the air around us), making it more likely to catch fire.

Second, lithium’s reactivity means it suffers side reactions with the battery’s liquid electrolyte, which is itself an energy-rich medium. These undesirable reactions reduce the amount of lithium available and worsen the battery’s life with every charge-discharge cycle.

Third, when a lithium-metal battery discharges, lithium ions separate from the surface of the anode and travel to the cathode. When the battery is charged the same ions travel back and deposit onto the anode as lithium metal. But instead of forming a nice smooth coating on the anode, lithium metal has the tendency to generate “dendrites,” chains of lithium atoms growing from the surface of the anode, which look like the roots of a tree. The dendrites grow bigger with each charge-discharge cycle, eventually reaching the cathode and causing the battery to short, leading to fires.

As the industry struggled through these problems in the late 1980s, Sony invented the graphite anode. Though less energy-dense, it suddenly made lithium batteries a lot safer and more reliable. Since then, graphite anodes have remained the mainstay of the industry.

Nearly 30 years later, however, we are brushing up against the limitations of the graphite anode. Next-generation applications such as cheap electric cars and electric airplanes will need batteries that carry the same amount of energy but weigh a lot less and take up a fraction of the space of today’s batteries. A slew of companies are in a race to build the next revolutionary anode, and venture capitalists are pumping in hundreds of millions of dollars in the hope of making a winning bet.

The zero-lithium state

To counteract lithium’s high reactivity, some battery developers have tried to install additional safety equipment to keep the lithium from coming into direct contact with water, oxygen, or nitrogen inside the battery. That inevitably increases the cost of manufacturing.

Some customers, such as commercial-drone users, are willing to pay premium prices. But Eaglesham believes it also means such battery makers don’t have a business that can scale beyond niche markets.

Even if somehow the costs could be reined in, batteries with lithium metal inside are less likely to pass safety tests, according to Eaglesham. These tests are designed to put the battery in extreme, but real-life, conditions: piercing a nail into the battery (which might happen in a car accident) or heating it to more than 50°C, or 122°F (a temperature that the interiors of cars or drones can easily reach).

The industry is littered with examples of companies that tried to build a lithium-metal battery but failed. For example, Arizona-based Sion Power built a lithium-sulfur battery (where the anode is lithium metal and cathode is made of sulfur) and used it for record-setting unmanned autonomous vehicles flights. But it abandoned the technology before reaching commercial scale. (It is still trying to develop lithium-metal batteries, but this time with a different cathode.)

That’s why Pellion’s battery doesn’t start with lithium metal inside. Instead, the battery is manufactured in the exact same way as a conventional lithium-ion battery, including using a liquid electrolyte, a widely available cathode—and an anode that begins its life as a copper sheet. That’s crucial because it allows Pellion to use existing lithium-ion battery factories in Asia, where it’s much cheaper to manufacture batteries.

In its discharged state, the Pellion battery has its lithium ions sitting snugly inside the cathode. The magic happens when the battery is charged for the first time, and the lithium ions travel from the cathode and deposit as a layer of lithium metal on the copper anode. The first charge is carried out in a state when the battery is completely sealed from the outside environment, and thus the newly formed layer of lithium metal is protected. This configuration is called “zero-lithium” or “lithium-free.”

“It is quite an impressive feat,” says Venkat Viswanathan, a battery expert at Carnegie Mellon University. Another expert (who asked not to be named due to press restrictions at their lab) called it the “holy grail” of the lithium-metal battery.

Market niche to market king

Pellion’s battery does have limitations. It typically takes three hours to charge the battery fully, and it’s not cheap. While experts Quartz spoke to about Pellion’s battery were impressed by the achievement, many expressed concerns about the limited number of life cycles: it can only guarantee 50 charge-discharge life cycles.

That’s much lower than the approximately 300 life cycles needed for a battery to go in a smartphone or the 1,000 life cycles required for electric cars. Eaglesham says the company’s latest models in development can last much more than 50 charge-discharge lifecycles than the batteries it sells. But Viswanathan says that going from 50 life cycles to 500 is a much harder proposition than what Pellion has achieved so far. Steven Visco agrees. He is the CEO of PolyPlus, a California-based startup, and he thinks that using a liquid electrolyte, which Pellion’s battery does, fundamentally limits how many lifecycles a lithium-metal battery could achieve.

That said, “battery startups struggle to find customers for their early products,” says Venkat Srinivasan, a lead battery researcher at Argonne National Laboratory. “So it’s an achievement that Pellion is already shipping product.” Quartz reached out to 10 other startups working on lithium-metal batteries for comment, and got replies from six. Sion Power, PolyPlus, Solid Energy Systems, and Ion Storage Systems said they are in the validation phase, sending engineering prototypes to potential customers and third-party testers. QuantumScape and Blue Current declined to comment.

Delivery of a lithium-metal battery product is a “major breakthrough,” says Eaglesham. Pellion’s first customers are makers of commercial drones. (Quartz was shown documents confirming sales on the condition of keeping the buyer’s identity confidential.) The startup began selling its batteries in February this year, and it expects to have several million dollars in revenue by the end of the year.

“Current battery technology underserves the drone market,” says Eaglesham. “We’ve found that some users have such a hunger for longer flight times that the number of battery life cycles doesn’t matter.”

The biggest prize for battery companies right now is the electric-car market. Bloomberg New Energy Finance expects that 10% of all cars sold in 2025 will be electric. To meet that demand, the battery industry will have to quintuple in size and produce some $60 billion worth of batteries annually.

Given the limitations, Eaglesham isn’t thinking about electric cars just yet. But his battery’s specifications make it a good candidate. For comparison, lithium-ion cells in electric cars like Tesla stand at 600 watt-hours per liter (Wh/l) and 220 watt-hours per kilogram (Wh/kg). Pellion’s figures are nearly double: 1,000 Wh/l and 400 Wh/kg. The promise of a leap in battery technology has allowed the startup to raise “tens of millions” of dollars, says Eaglesham, from the likes of Khosla Ventures and Motorola Solutions.

Beyond the hype

As a fast-growing industry with the potential of creating billion-dollar companies, battery inventors are known to operate in secrecy. But that means, without proper third-party verification, it’s hard to separate the truth from hype. That’s why it’s not surprising so many promising battery startups have gone bust in the past decade alone.

In 2012, for example, Envia was among the first crown jewels of the then three-year-old US advanced energy program (ARPA-E). Envia promised a lithium-ion technology that would make a leap in energy density and thus slash the cost of electric cars. It even convinced General Motors to sign a deal and invest millions of dollars. At the time, the car giant desperately needed a new battery for the next-generation Chevy Volt that was due in 2016. But after raising nearly $30 million and spending 10 years in operation, Envia fell short on delivering its magical battery and went out of business in 2017.

So Pellion’s claims need to be taken with a grain of salt. The only independent academic who has seen Pellion’s technology in action declined to comment for this story. Eaglesham says the company’s customers have validated its technology, but he declined to put Quartz in touch with them, citing confidentiality agreements.

Other experts Quartz consulted back the credentials of Eaglesham and his team. Pellion’s co-founders may have been first-time entrepreneurs; in Eaglesham, however, they have an experienced hand.

Eaglesham was previously the chief technology officer of First Solar, which proved itself a rare success in the cut-throat solar-photovoltaic-cell business. Co-founder Gerd Ceder now sits on Pellion’s board of directors, and he says that Eaglesham has been successful at Pellion because he has a handle on both commercial and technical aspects.

“Commercializing batteries is an extremely hard problem. Most startups end up in bullshit land,” Ceder says. “They are run by CEOs who are all about raising money and ratcheting up the stakes…before the crash. Pellion is different.”

🌍 Quartz is running a series called The Race to Zero Emissions that addresses the challenges and opportunities of energy-storage technologies. Sign up here to be the first to know when stories are published.