The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

It’s too soon to call it a comeback, but Instagram’s Threads is growing again.

After launching in July, the social media platform, pitched as a friendly, troll-free alternative to Twitter (now X), attracted 100 million users in under a week. Many of those early adopters soon drifted away; by the end of July, market intelligence firm Sensor Tower found daily active users had dropped by 82 percent.

But Instagram has kept plugging Threads, featuring posts from the app on Instagram users’ feeds and introducing a desktop version in August. Those efforts appear to be working: According to Sensor Tower data, monthly active users rose 3 percent to 81 million globally in October.

Still missing are many of the biggest fashion and beauty brands and influencers, however.

ADVERTISEMENT

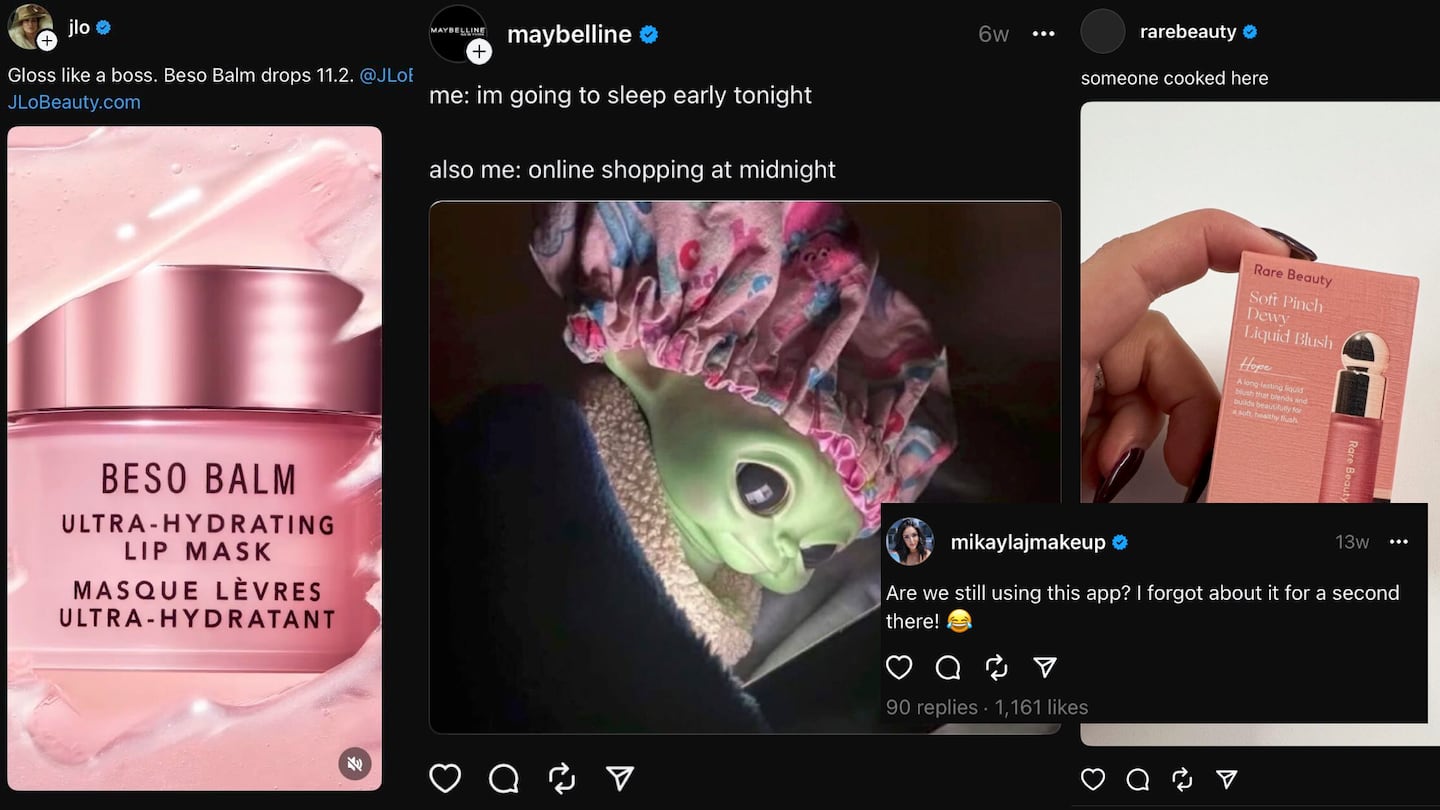

Rihanna and Hailey Bieber haven’t bothered to create Threads accounts, while Kim Kardashian and Kylie Jenner are on the platform but have never posted. Selena Gomez only has two posts, the most recent being an August promo for a new single. Among TikTok’s beauty it-girls, Mikayla Nogueira has gone 13 weeks without posting and Alix Earle never joined.

Brands known for going all-out on new social platforms are also keeping their efforts basic for now—E.l.f. Beauty posts between three and four times a week, much less frequently than it posts its daily time-intensive TikTok videos. Rare Beauty’s last post was one week ago, using the Breaking Bad-inspired “someone cooked here” meme to promote blush.

So while Threads looks like it might have some staying power, beauty and fashion aren’t ready to embrace it. The question is, why not?

For starters, Threads still is not yielding engagement and follower counts for brands on par with Instagram or TikTok. Fenty Beauty has accumulated 872,000 on Threads, compared to 12.7 million on Instagram. The text-heavy format (each post contains up to 500 characters, with an option to add images or video) isn’t as friendly to brands that rely on intense visuals to sell mascara or ready-to-wear; Twitter was never a major factor in most fashion or beauty brands’ marketing plans. And many brands and influencers might be wary of diving into yet another upstart social media platform, after initially promising investments in Clubhouse, Decentraland, BeReal, Triller and more failed to pay off.

But if the usage numbers keep ticking higher, expect that to change, especially with Threads’ link to Instagram.

“There is a very keen interest in Threads. That doesn’t necessarily mean that it’s come through all the way to execution,” said Christopher Douglas, the senior manager of strategy at influencer marketing agency Billion Dollar Boy. “It’s more like they’re dogs sniffing around a bit, seeing what the environment is actually like for brands.”

In a July Thread, Instagram head Adam Mosseri said the focus of the platform was on cultivating content around sports, music, fashion, beauty and entertainment rather than politics and hard news.

While he did not explicitly state how this content would be amplified, Meta has made similar announcements about its platforms in the past. In 2018, Mark Zuckerberg announced that Facebook’s algorithm would be changed to prioritise posts by friends and family over news links.

ADVERTISEMENT

Ultimately, this positioning is intended to create a more brand-friendly environment for advertisers than X, where Elon Musk’s changes to the platform have sent advertising revenue plunging by an estimated 54 percent, according to analytics firm Guideline.

“Twitter was brand-safe prior to Elon, and that’s a little bit of that void that we’re starting to see [filled] in the Threads space, where it’s a much more brand-safe environment,” said Douglas.

Brand-friendly features are reportedly on the horizon for Threads. There is no advertising on the app currently. But Axios has reported that the Instagram team is working on bringing its paid partnership labels over to the new platform. Full advertising will likely follow once the service takes off.

After some early experimentation, many brands appear to have reached the conclusion they should wait for those features to roll out before going all-in on Threads.

American Eagle posted on Threads 130 times by July 31, but has not published anything on the platform for four weeks. Clinique hasn’t posted in 13 weeks; L’Oréal Paris has gone 15. Many luxury brands, including Dior, Gucci and Chanel, haven’t joined yet (though to be fair, Chanel is yet to create a TikTok account).

Maybelline launched its account on the first day Threads was available. It drew 100,000 followers within 24 hours, and its team posted several times a day. But one month in, engagement for the brand plummeted by 50 percent compared to the first week. The team’s posting frequency has dropped, and it has not done any influencer campaigns on the app.

“We’re definitely just kind of testing it out,” said Sarah Shaker, the head of brand engagement at Maybelline. “We always want to make sure that when we’re putting content out on any platform, there’s a reason for it--either for it to be entertaining, or educational, or really just trying to be helpful and culturally relevant. If it’s not going to be any of those things, we don’t want to post just for the sake of posting.”

For many in the beauty industry, Threads is unlikely to rival the visually oriented TikTok or Instagram, no matter how big it gets.

ADVERTISEMENT

“I haven’t really used it much since the first week,” said Dr. Muneeb Shah, a dermfluencer with 18 million followers on TikTok and 95,200 on Threads. “I was excited at first, but text-based communication is really not my preferred format.”

Convincing influencers to embrace Threads is the key to luring both users and brands, experts say.

“It would probably end up taking influencers … to really be focused and doing something interesting or cool or different there, so it’s driving everyone else to want to be there,” said Shaker.

A few celebrities are active Threads users, though few have matched their cultural impact on other platforms. JLo, for instance, has 5.5 million Threads followers, versus 252 million followers on Instagram.

A recent post, captioned “date night” and featuring the star in a green dress, illustrated the engagement gap between the two platforms: on Threads, 29,000 users have liked the post. On Instagram, likes are up to 1.2 million and counting.

Meta’s social network, which launched Wednesday, is the biggest competitor yet to the Elon Musk-owned platform and potentially gives fashion an important new channel for reaching audiences.

Brands including Nike, American Eagle and Fashion Nova have jumped on Meta’s Twitter alternative, but the app has yet to prove its staying power or that it offers real benefits to fashion brands.

Liz Flora is a Beauty Correspondent at Business of Fashion. She is based in Los Angeles and covers beauty and wellness.

The Spanish beauty and fashion conglomerate’s smart acquisitions and diverse portfolio could be a big draw for investors. Plus, Adidas is set to confirm its stellar first quarter.

How not to look tired? Make money.

In a rare video this week, the mega-singer responded to sceptics and gave the public a look at what her beauty founder personality might be.

Request your invitation to attend our annual gathering for leaders shaping the global beauty and wellness industry.